Many people dream of achieving financial stability, but for those living paycheck to paycheck, that goal can seem like a distant reality. If you’re constantly juggling bills, scraping by to make ends meet, and stressed about the next unexpected expense, you might wonder if there’s a way out. The good news is, there is—and it’s a strategy that’s not only simple but incredibly effective: aging your money.

Aging your money is a powerful financial strategy that can help you get ahead of your bills, reduce stress, and ultimately build a buffer that allows you to handle life’s ups and downs with ease. In this post, we’ll explore what aging your money really means, how to implement it in your own life, and why it’s so much more than just a budgeting technique—it’s a way to achieve lasting financial stability.

What is Aging Your Money?

Aging your money means creating a financial buffer between when you receive your income and when you need to spend it. Instead of using this month’s paycheck to pay this month’s bills, the goal is to get ahead of your expenses so that you’re using last month’s income to cover this month’s expenses. This may sound simple, but the impact is profound.

If you’re always relying on your next paycheck to pay for today’s expenses, you’re constantly on the edge, with no room for flexibility or mistakes. One unexpected bill, a drop in income, or a delay in getting paid can send your entire financial situation spiraling. But when you age your money, you give yourself breathing room.

The Benefits of Aging Your Money

1. Reduced Financial Stress

One of the biggest benefits of aging your money is the psychological relief it provides. Living paycheck to paycheck is stressful. You’re always worrying about whether you’ll have enough money to cover your bills, and that stress can take a toll on both your mental and physical health.

When you age your money, you reduce that constant worry. Knowing that you have next month’s bills already covered gives you peace of mind and allows you to focus on bigger financial goals rather than just surviving day to day. Financial stress can increase levels of cortisol, a hormone that contributes to weight gain, particularly around the midsection .

2. More Control Over Your Finances

When you’re living paycheck to paycheck, it feels like you’re always playing catch-up. You’re constantly reacting to bills, expenses, and financial emergencies as they arise, rather than proactively planning for them. Aging your money flips the script. Instead of being reactive, you become proactive. You can plan for future expenses, budget more effectively, and avoid costly late fees or missed payments.

3. Building a Buffer for Emergencies

Life is unpredictable, and no matter how carefully you budget, there will always be unexpected expenses. A car repair, medical bill, or home emergency can throw even the most well-planned budget into chaos. But when you age your money, you’ve already built a financial buffer that allows you to handle these emergencies without going into debt or scrambling for cash. Over time, this buffer grows into a fully funded emergency fund, which is essential for long-term financial stability.

4. Breaking the Paycheck-to-Paycheck Cycle

Aging your money is a crucial step in breaking free from the paycheck-to-paycheck cycle. Once you start aging your money, you’ll no longer need to rely on your next paycheck to make it through the month. You’ll be ahead of your expenses, which means that your income is no longer earmarked for bills the moment it hits your bank account. Instead, you can start using your income to build savings, pay off debt, or invest in your future.

How to Start Aging Your Money

Now that we’ve covered what aging your money is and why it’s so powerful, let’s dive into how you can start implementing it in your own life.

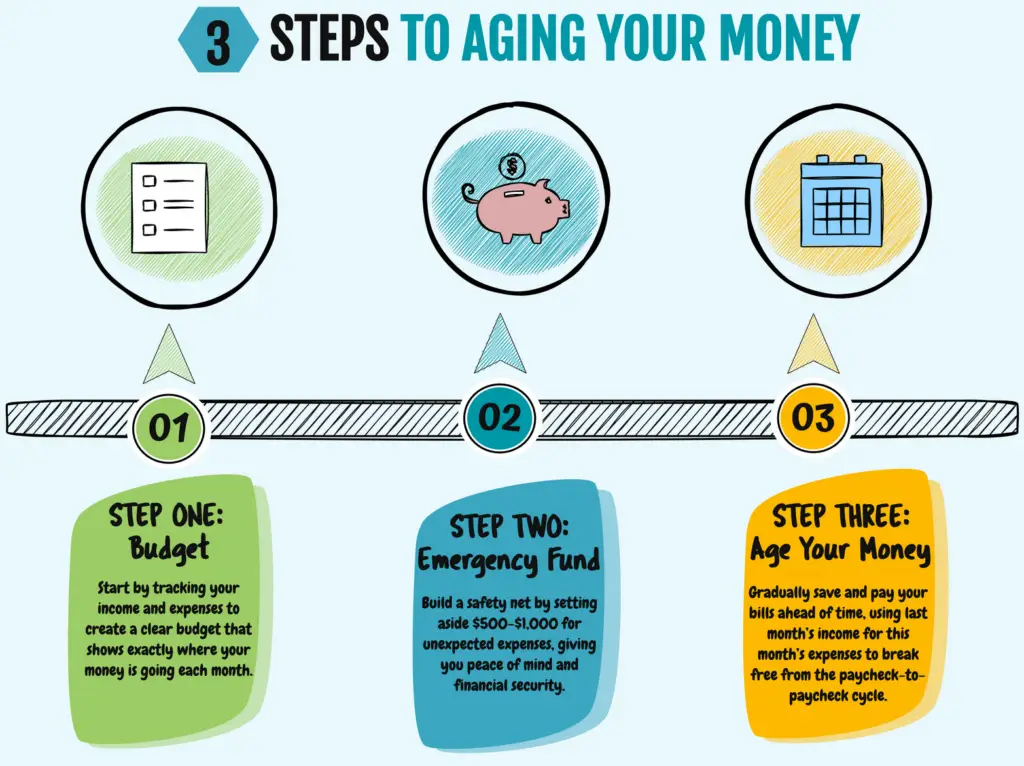

1. Start by Creating a Budget

The first step to aging your money is knowing where your money is going. Create a budget that tracks all of your income and expenses. Be as detailed as possible, including everything from rent and utilities to groceries, transportation, and entertainment. Once you have a clear picture of your financial situation, you can start to look for areas where you can cut back and free up extra cash to build your buffer.

2. Build a Small Emergency Fund

Before you can start aging your money, it’s important to have a small emergency fund in place. Aim for a starter emergency fund of at least $500 to $1,000. This fund will act as a safety net in case of unexpected expenses, allowing you to avoid dipping into your buffer. Having even a small emergency fund will give you the confidence to start aging your money without worrying about running out of cash if something goes wrong.

3. Start Paying Bills in Advance

Once you have a budget and an emergency fund in place, it’s time to start aging your money. Begin by paying your bills in advance. Start with the bills that are easiest to get ahead on, such as utilities, rent, or credit card payments. The goal is to gradually get to the point where you’re paying your bills a month in advance.

For example, if you receive a paycheck in January, use that money to pay February’s bills. Over time, this will become your new normal, and you’ll always be a month ahead on your expenses.

4. Allocate Extra Funds Wisely

As you begin to age your money and free up extra funds, it’s important to allocate that money wisely. If your emergency fund isn’t fully funded, focus on building it up to at least three to six months’ worth of living expenses. After that, you can start putting extra money toward paying off debt, saving for retirement, or other financial goals.

Aging Your Money Isn’t Just About Savings

One important thing to remember is that aging your money isn’t just about accumulating savings. It’s also about creating a financial system that allows you to manage your money in a way that reduces stress and builds long-term stability. For many people, aging their money involves a combination of building up savings, paying bills ahead of time, and managing expenses more effectively.

For example, I’ve found that buying household essentials in bulk is a great way to age my money. By stocking up on items like toilet paper, shampoo, and cleaning supplies, I don’t have to worry about running out or needing to dip into my budget to buy these items every month. There are several ways to buy in bulk, including Walmart.com, Costco, Sam’s Club, Boxed.com, and Amazon’s Subscribe & Save.

When you plan ahead and pay bills or make purchases in advance, you create a buffer that protects you from financial uncertainty. This can give you the freedom to focus on other financial goals, like paying off debt or investing for the future.

The Psychological and Physical Benefits of Aging Your Money

The financial benefits of aging your money are clear, but what’s often overlooked are the psychological and physical benefits that come with it. When you’re constantly stressed about money, it can have a negative impact on your mental health, leading to anxiety, depression, and even physical symptoms like headaches and insomnia.

As mentioned earlier, chronic stress raises cortisol levels, which can lead to weight gain, particularly in the abdominal area . Cortisol is your body’s stress hormone, and while it’s helpful in short bursts, prolonged exposure to elevated cortisol levels can slow your metabolism, increase your cravings for sugary or fatty foods, and make it harder to lose weight. By reducing financial stress through aging your money, you’re not only improving your financial situation, but also your overall health and well-being.

Aging your money provides peace of mind, which leads to better sleep, improved mood, and a greater sense of control over your life. These psychological benefits can have a ripple effect, improving your relationships, productivity, and long-term success.

How Aging Your Money Helps You Break Free from the Paycheck-to-Paycheck Cycle

For millions of people, living paycheck to paycheck is a daily reality. But it doesn’t have to be this way. Aging your money offers a clear path to breaking free from this cycle. By getting ahead of your bills, you stop the constant stress of wondering if you’ll have enough to cover your expenses.

One of the reasons people get stuck in the paycheck-to-paycheck trap is because they don’t have a financial buffer. Without that buffer, any unexpected expense can send their finances into a tailspin. This is why aging your money is so crucial—it helps you build that buffer, allowing you to cover expenses with ease and avoid going into debt when something goes wrong.

Start Aging Your Money Today

If you’re ready to take control of your finances and start aging your money, the best time to start is now. Even if you’re not able to get ahead of all your bills right away, taking small steps—like paying one bill in advance or setting aside extra funds for next month—can make a big difference.

Remember, aging your money is a gradual process. It doesn’t happen overnight, but with consistency and planning, you can build a financial buffer that gives you the stability and peace of mind you’ve been looking for.

The Workbook: A Tool for Aging Your Money

If you’re ready to take this method further, I’m working on a step-by-step guide, Low Income, Rich Life: Financial Security Through Aging Your Money. This workbook will walk you through every step of the process—from tracking your income and expenses to setting up a budgeting system that encourages you to get ahead of your bills.

Inside the workbook, you’ll find:

• Income and Expense Worksheets to help you organize your cash flow and ensure that nothing is missed.

• A monthly bill calendar that lets you visually map out your paydays and due dates.

• Paycheck allocation worksheets to plan how to use each paycheck to gradually build a financial buffer.

• A debt worksheet to help you tackle debt in a structured way, separate from your regular expenses.

By following the steps in the workbook, you’ll be able to build an emergency fund, pay off debt, and—most importantly—age your money so that you can stop living paycheck to paycheck.

Take Action Today

If you’re feeling overwhelmed by your finances or stuck in the paycheck-to-paycheck cycle, start with small actions. Identify one or two bills that you can pay early. Gradually, you’ll start to notice a change in how you manage your finances, with less stress and more control.

Thanks for reading! If you found this post helpful, share it with someone who might benefit from learning how to age their money. And be sure to stay tuned for more tips, strategies, and updates on the workbook! Join our Facebook group here to be a part of our supportive community where we are working toward financial security together—one step at a time.