Introduction

Retirement is a phase of life that many look forward to, but it requires careful planning and preparation. If you’re wondering how to build a retirement fund from scratch, you’re not alone. Many people feel overwhelmed at the thought of starting a retirement savings plan, especially if they’re getting a late start. The good news is that it’s never too late—or too early—to begin saving for retirement. Whether you’re in your 20s, 30s, 40s, 50s, or even closer to retirement age, there are actionable steps you can take today to secure a comfortable future.

This guide will provide a comprehensive overview of step-by-step retirement planning, explain the different types of retirement accounts, and offer practical tips on how to maximize your savings. By the end of this post, you’ll have a clearer understanding of how to start a retirement savings plan that’s tailored to your unique needs and goals. Let’s dive in and start building your path to a financially secure retirement.

Understanding Retirement Accounts

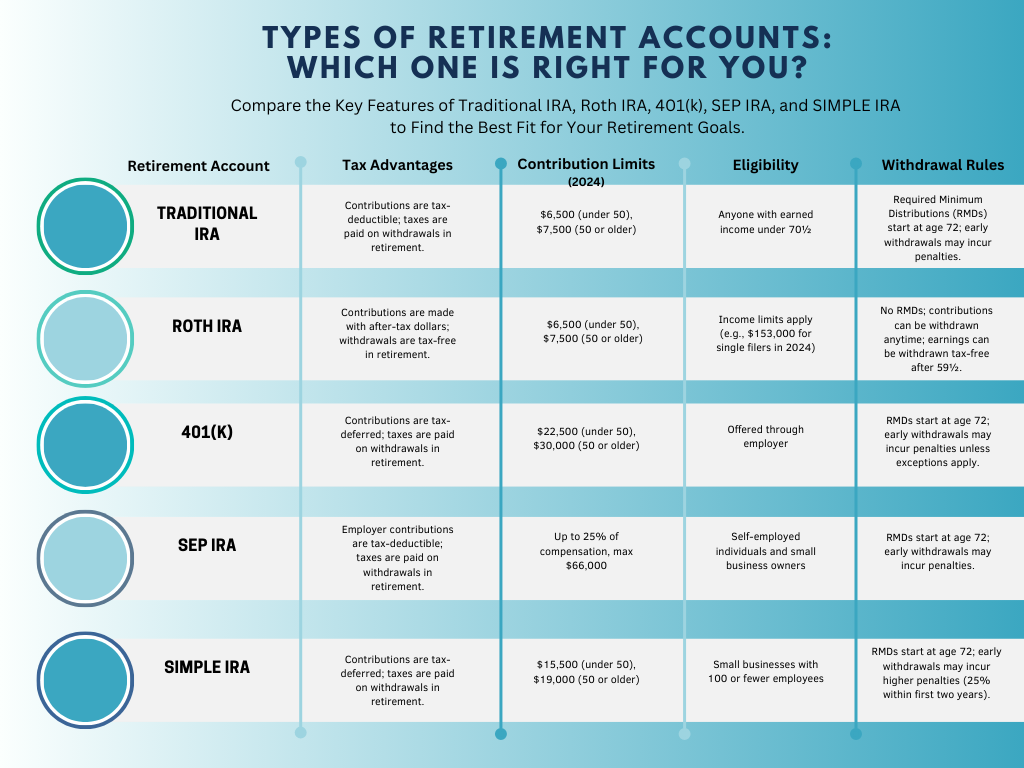

The foundation of any solid retirement savings plan is understanding the different types of accounts available. Each type of retirement account offers unique benefits and rules, so it’s important to know which one aligns with your financial goals and situation. Here’s a closer look at the primary retirement savings account types:

1. Traditional IRA (Individual Retirement Account): A Traditional IRA allows you to contribute pre-tax income, which can help reduce your taxable income for the year. The money in your IRA grows tax-deferred, meaning you won’t pay taxes on it until you withdraw it in retirement. This type of account might be suitable if you expect to be in a lower tax bracket when you retire, as withdrawals will be taxed as ordinary income. Additionally, Traditional IRAs have a wide range of investment options, including stocks, bonds, mutual funds, and more.

2. Roth IRA: A Roth IRA differs from a Traditional IRA in that contributions are made with after-tax dollars. The key advantage here is that qualified withdrawals during retirement are completely tax-free. This is a great option if you anticipate being in a higher tax bracket during retirement or if you want more flexibility with your contributions and withdrawals. Roth IRAs also allow for contributions to be withdrawn at any time without penalty, which can provide added peace of mind in case of an emergency.

• Different Types of Roth IRAs: Beyond the standard Roth IRA, there are specialized types like the Self-Directed Roth IRA, which allows for more diverse investment options such as real estate, precious metals, or private equity. This flexibility can be a great benefit for those looking to diversify their retirement portfolio beyond traditional stocks and bonds.

3. 401(k) Plans: These are employer-sponsored retirement plans that allow you to contribute a portion of your salary pre-tax. One of the significant advantages of a 401(k) is the potential for employer matching contributions. Many employers match a percentage of your contributions, effectively giving you free money to save for retirement. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing at least 6% would maximize this benefit. Additionally, 401(k) plans often have higher contribution limits compared to IRAs, allowing you to save more aggressively.

4. SEP and SIMPLE IRAs: For self-employed individuals or small business owners, SEP (Simplified Employee Pension) and SIMPLE (Savings Incentive Match Plan for Employees) IRAs are excellent options. They offer higher contribution limits compared to standard IRAs, providing more opportunities to save for retirement. SEPs, for instance, allow contributions up to 25% of your compensation or a fixed dollar amount, whichever is less. This can be particularly advantageous for those who want to save large amounts periodically rather than on a regular basis.

5. Other Retirement Savings Account Types: In addition to the well-known accounts, there are other retirement savings options such as 403(b) plans for non-profit employees, 457 plans for government employees, and TSPs (Thrift Savings Plans) for federal employees. Each of these accounts has its own set of rules, benefits, and contribution limits, making it essential to understand the specifics of each.

By choosing the right retirement savings account types, you can optimize your savings strategy and ensure that you’re well-prepared for the future.

Advantages and Disadvantages of Each Account

When deciding how to start your retirement savings plan, it’s crucial to weigh the advantages and disadvantages of each account type. This helps you make an informed decision that aligns with your financial goals.

• Traditional IRA:

• Advantages: Tax-deductible contributions reduce taxable income, potential for tax-deferred growth. It’s a flexible option with a wide range of investment choices.

• Disadvantages: Mandatory minimum distributions (RMDs) start at age 72, withdrawals are taxed as ordinary income. Early withdrawals before age 59½ may incur a 10% penalty unless an exception applies.

• Roth IRA:

• Advantages: Tax-free withdrawals in retirement, no RMDs, contributions can be withdrawn anytime without penalty, more investment flexibility.

• Disadvantages: Contributions are not tax-deductible, income limits restrict eligibility for high earners. The amount you can contribute to a Roth IRA may be reduced or eliminated if your income is too high.

• 401(k) Plans:

• Advantages: High contribution limits, employer match opportunities, tax-deferred growth. Many plans offer automatic enrollment and contribution escalation, making it easier to save consistently.

• Disadvantages: Limited investment options depending on the plan, early withdrawal penalties, and required minimum distributions starting at age 72.

• SEP and SIMPLE IRAs:

• Advantages: High contribution limits, flexible contribution amounts, especially beneficial for self-employed individuals and small business owners.

• Disadvantages: Contributions are not allowed after age 70½ for SEP IRAs, and SIMPLE IRAs require mandatory employer contributions, which may not be ideal for all business types.

Understanding these pros and cons can help you choose the right account for your retirement savings plan. For more detailed comparisons, you may want to consider checking out our upcoming post on Health Savings Accounts (HSAs) to see how they can complement your retirement strategy.

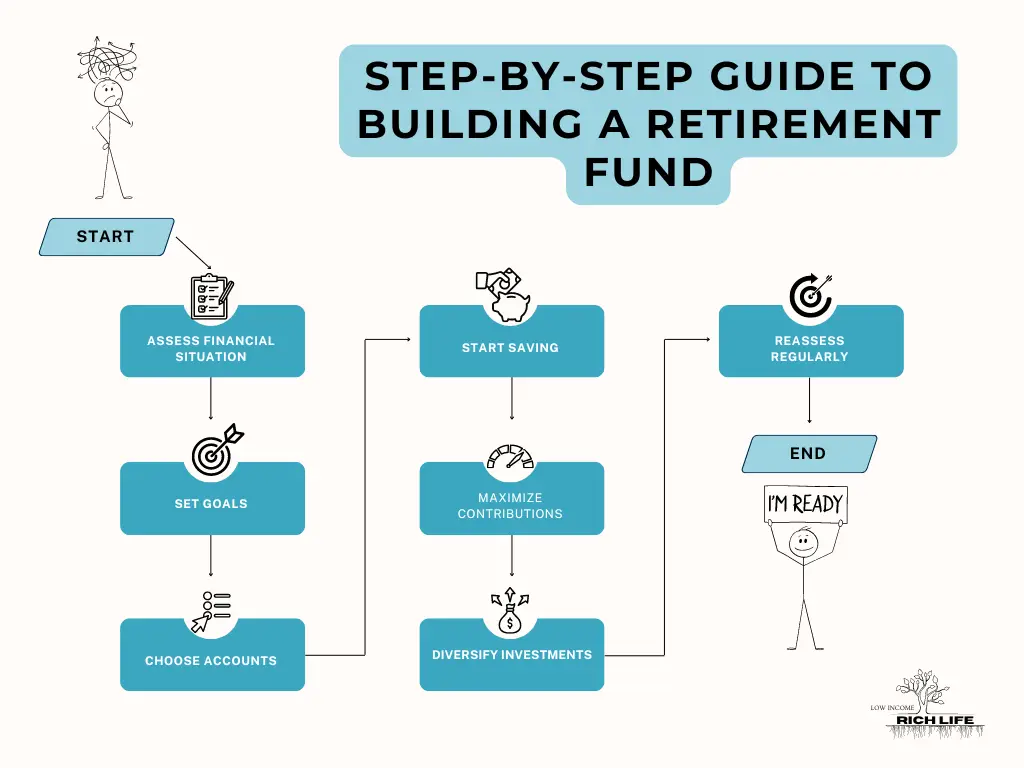

Step-by-Step Guide to Building a Retirement Fund

Building a retirement fund from scratch involves several key steps. Here’s a comprehensive guide to help you get started:

1. Assess Your Current Financial Situation: Start by taking a close look at your current financial status. This includes your income, expenses, debt, and any existing savings. Knowing where you stand will help you create a realistic plan. Create a detailed budget that tracks all sources of income and expenditures, and identify areas where you can cut back or reallocate funds toward your retirement savings.

2. Set Clear Retirement Goals: Determine how much you need to save for retirement. Consider factors such as your desired retirement age, lifestyle, expected healthcare costs, inflation, and life expectancy. Use our simple retirement calculator to get a rough estimate of how much to save for retirement. Break down this goal into smaller, more manageable milestones. For example, aim to save a certain amount by age 40, 50, and so on.

3. Choose the Right Retirement Accounts: Based on the information above, select the best retirement savings account types that align with your goals and situation. For many, a mix of a Roth IRA and a 401(k) plan (if available) provides a good balance of tax benefits. If you’re self-employed, consider the benefits of a SEP or SIMPLE IRA, which offer higher contribution limits.

4. Start Saving Early and Consistently: The earlier you start saving, the better, thanks to the power of compound interest. Even if you’re starting late, consistency is key. Set up automatic contributions to your retirement accounts to ensure you’re saving regularly. Even a small monthly contribution can grow significantly over time. If you’re starting in your 30s, you might need to save around 15% of your income; if you’re starting in your 50s, you might aim for 25% or more.

5. Maximize Employer Contributions: If you have access to a 401(k) plan with employer matching, contribute at least enough to receive the full match. This is essentially free money that can significantly boost your retirement savings. For example, if your employer matches 50% of the first 6% you contribute, you’re getting an immediate 50% return on your investment.

6. Diversify Your Investments: Diversifying your investments across different asset classes (stocks, bonds, real estate) can help manage risk and improve potential returns. If you’re unsure how to diversify, consider low-cost index funds or target-date funds, which automatically adjust asset allocation as you approach retirement. Investing in a mix of assets ensures that your portfolio is balanced and can weather market fluctuations.

7. Reassess and Adjust Your Plan Regularly: Life circumstances and market conditions change, so it’s important to review and adjust your retirement plan regularly. Make sure your savings rate and investment strategy align with your current situation and goals. Consider consulting with a financial advisor annually to review your progress and make adjustments as needed.

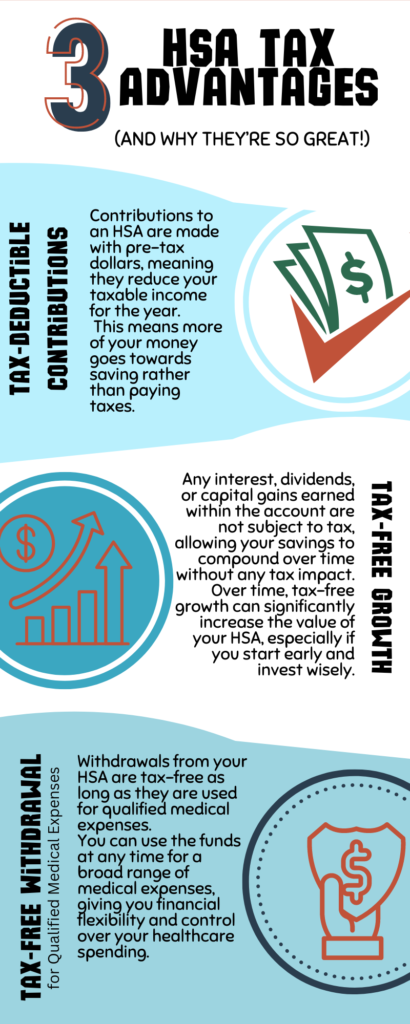

8. Consider Health Savings Accounts (HSAs) as Part of Your Plan: HSAs offer triple tax benefits—tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. They can be a valuable addition to your retirement strategy, especially if you anticipate significant healthcare costs in retirement. Unlike Flexible Spending Accounts (FSAs), funds in an HSA roll over year to year and can be invested in various assets. For a deeper dive into how HSAs can complement your retirement planning, check out our post on Health Savings Accounts (HSAs). By integrating an HSA into your retirement strategy, you can save for healthcare expenses while also growing your retirement fund.

9. Create a Backup Plan for Income in Retirement: Diversifying your income sources in retirement can provide financial stability. Consider additional income streams such as part-time work, rental income, or even starting a small side business. This approach can reduce your reliance on your retirement savings alone, providing more flexibility and security.

10. Factor in Inflation and Longevity: Inflation can erode the purchasing power of your savings over time, so it’s important to factor this into your retirement planning. Consider investments that typically outpace inflation, such as stocks or real estate. Additionally, plan for a longer retirement than you might expect; advancements in healthcare mean people are living longer, which could require more savings than initially planned.

Tips for Maximizing Retirement Savings

Maximizing your retirement savings is crucial to ensuring you have enough to live comfortably when you stop working. Here are some additional strategies to help you get the most out of your savings efforts:

• Take Advantage of Catch-Up Contributions: If you’re 50 or older, you’re allowed to make additional “catch-up” contributions to your 401(k) and IRA accounts. This can be a great way to boost your savings if you’re starting late. The IRS allows for an extra $6,500 in catch-up contributions to a 401(k) and an extra $1,000 to an IRA, providing a substantial increase in the amount you can save.

• Automate Your Savings: One of the best ways to ensure you save consistently is to automate your contributions. Set up automatic transfers from your checking account to your retirement savings accounts. This removes the temptation to spend the money elsewhere and makes saving a regular part of your budget.

• Reduce Debt and Lower Expenses: Reducing your debt load and lowering your monthly expenses can free up more money to contribute to your retirement fund. Focus on paying off high-interest debt first, such as credit card debt, to avoid paying more in interest than you earn on your investments. Additionally, consider downsizing your home or moving to a lower-cost area to reduce housing expenses.

• Increase Savings Gradually: If you’re unable to save a lot initially, start small and increase your savings rate gradually. For instance, increase your contribution by 1% each year or whenever you get a raise. Over time, these small increases can add up significantly and help you reach your retirement goals without feeling a major impact on your budget.

• Utilize Tax-Efficient Investment Strategies: Invest in tax-efficient funds and consider the tax implications of your investments. For example, holding dividend-paying stocks or high-yield bonds in a tax-deferred account like a Traditional IRA can help reduce your current tax burden while maximizing your investment growth.

• Review and Rebalance Your Portfolio Regularly: Over time, the value of different investments within your portfolio can change, causing your asset allocation to shift away from your original plan. Regularly reviewing and rebalancing your portfolio ensures that it remains aligned with your risk tolerance and retirement goals. Aim to rebalance at least once a year or whenever your allocation deviates significantly from your target.

• Leverage Employer Benefits Beyond the 401(k): Some employers offer additional benefits that can help with retirement savings, such as Employee Stock Purchase Plans (ESPPs), profit-sharing plans, or access to financial wellness programs. Take full advantage of these opportunities to enhance your retirement planning strategy.

• Consider the Impact of Social Security: Understand how Social Security benefits fit into your retirement plan. While it’s unlikely to be your sole source of income, knowing how much you’re entitled to and the best time to start taking benefits can significantly impact your overall retirement strategy. Consider delaying Social Security benefits until full retirement age or later to maximize your monthly benefit.

• Use a Retirement Calculator for Ongoing Planning: Online retirement calculators can provide a more detailed picture of whether you’re on track to meet your savings goals. Update your inputs regularly as your income, expenses, and life circumstances change. This ongoing analysis will help you make informed adjustments to your plan.

Conclusion

Building a retirement fund from scratch may seem like a daunting task, but with the right planning and consistent effort, it’s entirely achievable. By understanding the different types of retirement accounts, creating a solid retirement savings plan, and maximizing your contributions, you can set yourself up for a financially secure retirement, no matter your starting point. Remember, the most important step is to start. Whether you’re in your 30s or nearing retirement, the best time to begin planning is now.

Be sure to explore additional resources like our post on Health Savings Accounts (HSAs) to further diversify and strengthen your retirement strategy. By taking control of your financial future today, you’re investing in peace of mind for tomorrow.

Additional Resources:

1. Investopedia – A comprehensive guide on retirement planning:

Link: Investopedia Retirement Planning Guide

For a deeper dive into the various aspects of retirement planning, check out Investopedia’s comprehensive guide. It covers everything from different types of retirement accounts to advanced investment strategies.

2. IRS Website – Information on Retirement Plans and Contribution Limits:

Link: IRS Retirement Plans

For the most accurate and up-to-date information on retirement account rules, contribution limits, and tax benefits, visit the IRS’s official page on retirement plans.

3. Fidelity – Retirement Calculator and Planning Tools:

Link: Fidelity Retirement Calculator

Use Fidelity’s Retirement Calculator to estimate how much you need to save for a comfortable retirement based on your unique circumstances and goals.

4. AARP – Resources for Late Starters in Retirement Planning:

Link: AARP Retirement Planning Resources

AARP offers valuable resources and advice for those starting retirement planning later in life, including tips on maximizing savings and making the most of catch-up contributions.

5. Social Security Administration – Official Social Security Benefits Information:

Link: Social Security Administration Retirement Benefits

Visit the Social Security Administration’s website for official information on retirement benefits, how to apply, and strategies for maximizing your benefits.

6. Morningstar – Investment Research and Analysis:

Link: Morningstar Retirement Planning

Morningstar provides in-depth research and analysis on various investment options for retirement, helping you make informed decisions about your portfolio.

7. Health Savings Accounts (HSAs) Overview by the U.S. Treasury:

Link: U.S. Treasury HSA Information

Learn more about how Health Savings Accounts (HSAs) can complement your retirement savings strategy by visiting the U.S. Treasury’s overview.