Introduction

Health Savings Accounts (HSAs) are often overlooked as a powerful tool for both managing medical expenses and saving for retirement. If you’re unfamiliar with HSAs, don’t worry—you’re not alone. In this guide, we’ll break down exactly what a Health Savings Account (HSA) is, the HSA tax advantages, how it compares to a Flexible Spending Account (FSA), and strategies for using an HSA to cover medical expenses both now and in retirement. By the end, you’ll have a clear understanding of how to make the most of this versatile savings tool.

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account designed specifically for medical expenses. To be eligible for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP), which is a type of health insurance plan with higher deductibles and lower premiums. The idea behind an HSA is to provide a way for individuals with HDHPs to save money specifically for healthcare costs.

But an HSA isn’t just about paying for medical expenses today. One of the biggest advantages of an HSA is that it can also be used as a retirement savings vehicle. Contributions to an HSA are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax benefit makes HSAs one of the most tax-efficient savings accounts available.

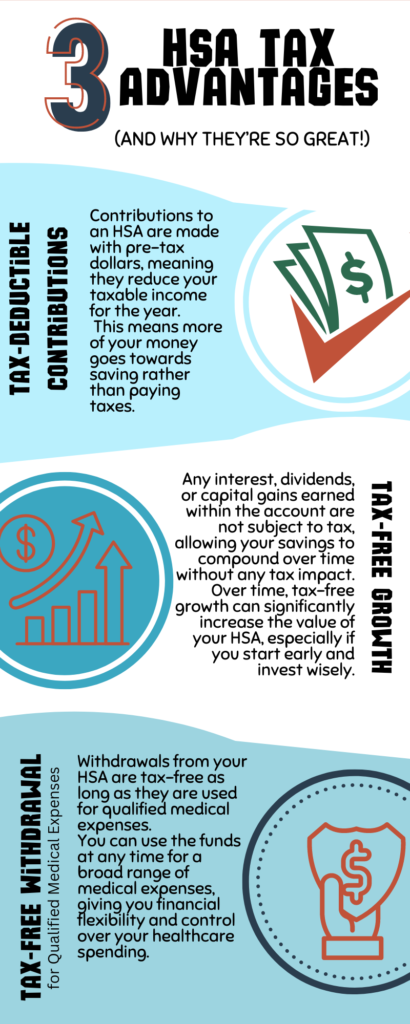

HSA Tax Advantages:

HSAs offer several key tax benefits that make them an attractive option for both short-term and long-term savings:

1. Tax-Deductible Contributions: The money you contribute to your HSA is tax-deductible, meaning it reduces your taxable income for the year. For example, if you contribute the maximum amount allowed to your HSA ($3,850 for individuals or $7,750 for families in 2024), you can deduct that amount from your income, potentially lowering your tax bill.

2. Tax-Free Growth: The funds in your HSA grow tax-free, similar to a Roth IRA or 401(k). Any interest, dividends, or capital gains earned within the account are not subject to tax, allowing your savings to compound over time without any tax drag.

3. Tax-Free Withdrawals for Qualified Medical Expenses: When you withdraw funds from your HSA to pay for qualified medical expenses, those withdrawals are completely tax-free. This includes a wide range of expenses, from doctor visits and prescriptions to dental care and even certain over-the-counter medications.

4. No “Use-It-Or-Lose-It” Rule: Unlike Flexible Spending Accounts (FSAs), which require you to use your funds within the plan year or forfeit them, HSAs have no expiration date. Any money you contribute to your HSA remains yours indefinitely, allowing you to build a substantial nest egg over time.

5. After Age 65, Withdrawals for Any Purpose: Once you reach age 65, you can withdraw funds from your HSA for any purpose without penalty, though you will pay ordinary income tax on withdrawals not used for qualified medical expenses. This feature makes an HSA similar to a traditional IRA after age 65.

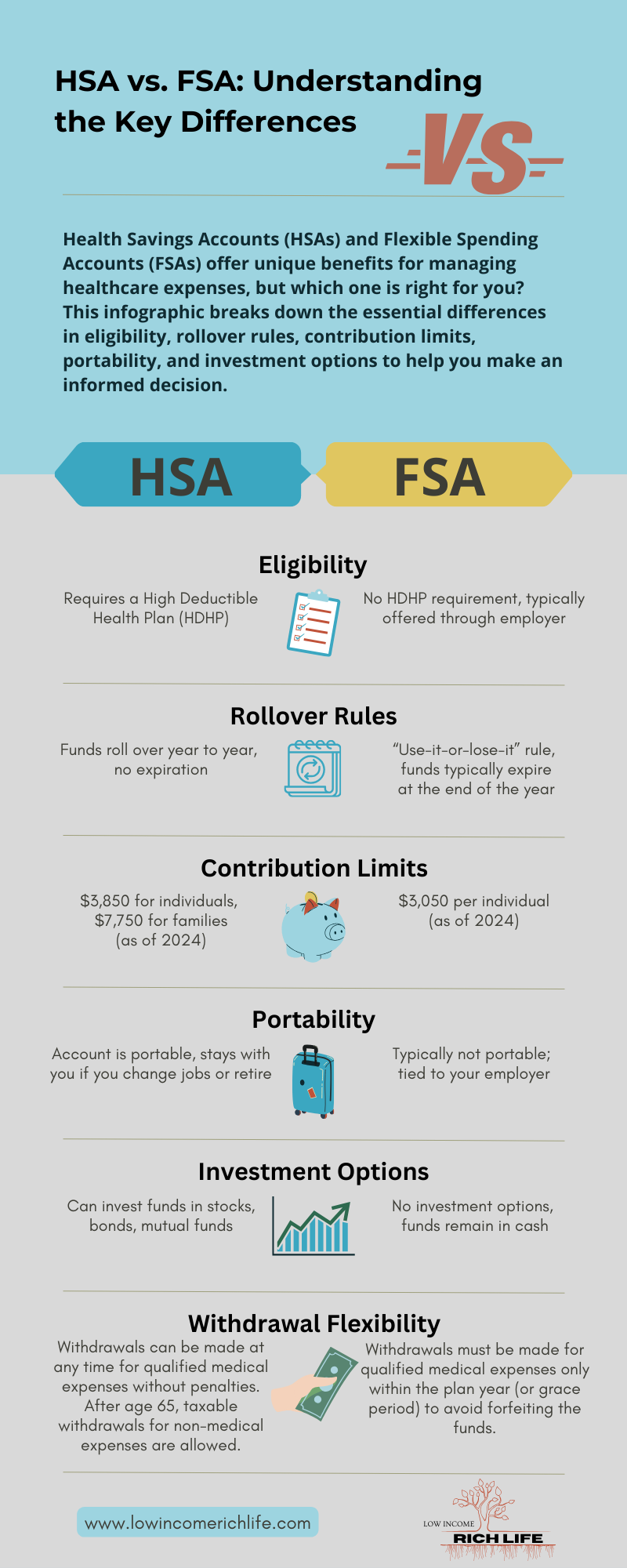

HSA vs. FSA: Key Differences and Similarities

While both HSAs and FSAs are designed to help individuals save for medical expenses, there are some important differences to understand:

• Eligibility: To contribute to an HSA, you must have an HDHP, whereas FSAs are often available through employer-sponsored health plans and do not require an HDHP.

• Contribution Limits: HSAs have higher contribution limits than FSAs. For 2024, the HSA contribution limits are $3,850 for individuals and $7,750 for families, compared to the FSA limit of $3,050.

• Rollover Rules: HSAs allow you to roll over any unused funds from year to year, while FSAs typically have a “use-it-or-lose-it” rule, meaning you forfeit any unused funds at the end of the year.

• Portability: HSAs are portable, meaning the account stays with you even if you change jobs or retire. FSAs are tied to your employer and typically cannot be taken with you if you leave your job.

• Investment Options: HSAs often offer investment options, allowing you to invest your funds in stocks, bonds, mutual funds, or other vehicles, much like a 401(k) or IRA. FSAs do not offer investment options.

• Withdrawal Flexibility: HSA funds can be used tax-free for qualified medical expenses at any time, while FSA funds must typically be used within the plan year.

Understanding these differences can help you decide which account is right for you, or if an HSA might be a better fit for your long-term savings goals.

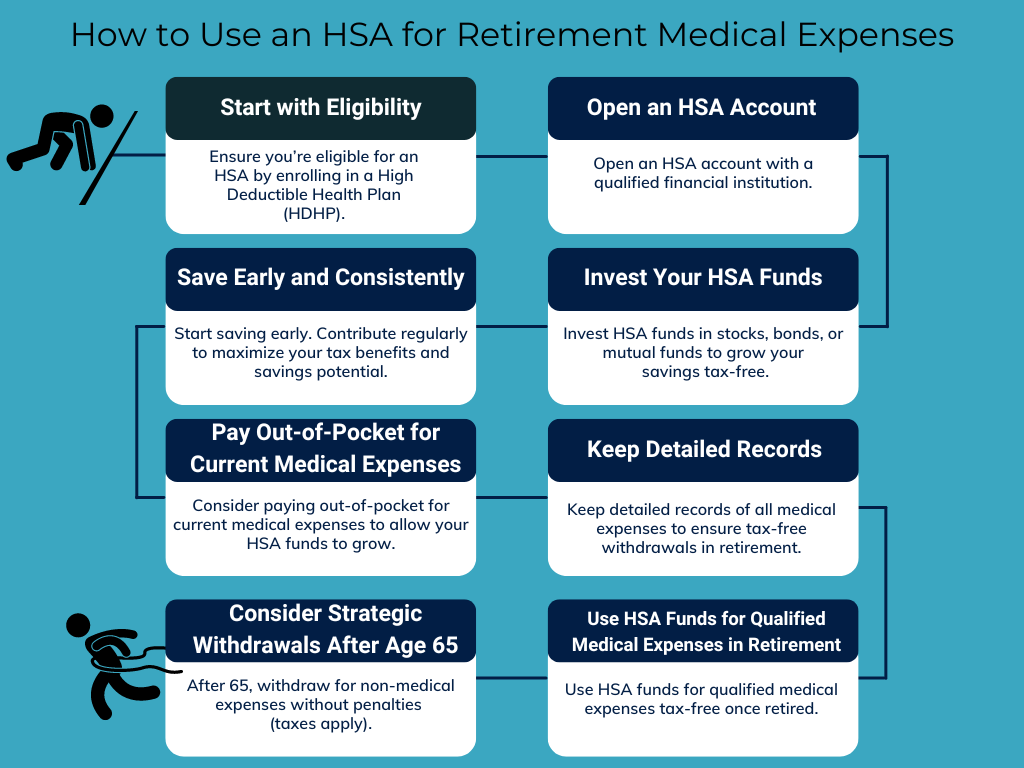

Using an HSA for Retirement Medical Expenses

One of the lesser-known benefits of an HSA is its potential as a tool for retirement planning. Medical expenses are a significant cost in retirement, and HSAs provide a tax-advantaged way to save specifically for these expenses.

• Tax-Free Withdrawals for Medical Expenses: In retirement, you can use your HSA funds to pay for a wide range of qualified medical expenses, including Medicare premiums, long-term care insurance premiums, and out-of-pocket costs like co-pays and deductibles, all on a tax-free basis.

• Saving for Future Medical Costs: Because HSAs allow your money to grow tax-free, they are an excellent way to save for future medical expenses. Even if you are currently healthy, setting aside money in an HSA can help cover costs if your health needs change later in life.

• Paying Out of Pocket to Let HSA Funds Grow: One strategy to maximize the growth potential of your HSA is to pay for current medical expenses out of pocket and let your HSA funds continue to grow tax-free. You can reimburse yourself later for these expenses, even years down the line, provided you keep good records of the expenses. This approach allows you to take advantage of the tax-free growth potential of your HSA funds, potentially increasing your retirement savings significantly.

• Record-Keeping for Tax-Free Withdrawals: If you choose to pay out of pocket and save your HSA funds for later, it’s crucial to keep detailed records of all medical expenses you plan to reimburse yourself for. This could be in the form of receipts, invoices, or a digital log. Keeping good records ensures you can withdraw the funds tax-free later, providing flexibility in retirement. For example, if you pay $500 out of pocket for a medical procedure this year and decide to reimburse yourself 10 years later, you’ll need that receipt to show it was a qualified expense.

Case Study: Jane’s Strategic HSA Use

Let’s consider Jane, who is 45 and has been contributing to her HSA for the past 10 years. Jane is in good health and decides to pay for most of her minor medical expenses out of pocket while allowing her HSA to grow. By age 65, Jane’s HSA balance has grown significantly thanks to the tax-free growth and her wise investment choices. Now, in retirement, Jane can use her HSA funds to cover Medicare premiums and other healthcare costs without dipping into her other retirement savings. This strategy has allowed Jane to effectively use her HSA as a supplemental retirement account, offering her more financial security and flexibility.

Using an HSA as a Retirement Savings Vehicle

Beyond covering medical expenses, an HSA can also serve as a powerful retirement savings tool. Here’s how to maximize its potential:

1. Investing Your HSA Funds: Once you accumulate a certain balance in your HSA (typically $1,000 or more, depending on the provider), you can start investing those funds in a range of investment options, similar to how you might invest in a 401(k) or IRA. This can significantly boost the growth potential of your HSA. Over time, investing in a diversified mix of stocks and bonds can help your HSA grow at a rate that outpaces inflation and increases your purchasing power in retirement.

2. Long-Term Growth: By investing your HSA funds and allowing them to grow over time, you can build a substantial nest egg that can be used for medical expenses or even as a supplemental retirement account. This is particularly beneficial given the tax advantages associated with HSAs. For example, if you contribute the maximum amount to your HSA every year and invest those funds in a balanced portfolio, you could potentially grow your HSA to hundreds of thousands of dollars by the time you retire.

3. Strategic Withdrawals After Age 65: After age 65, you can use your HSA funds for non-medical expenses without a penalty, though you will pay ordinary income tax on those withdrawals. This feature makes an HSA a flexible retirement account that can be used to cover a wide range of expenses beyond healthcare. Consider using your HSA funds for other retirement expenses, like travel or home improvements, if needed.

4. Combining an HSA with Other Retirement Accounts: For a diversified retirement savings strategy, consider combining an HSA with other accounts like a 401(k), Traditional IRA, or Roth IRA. This approach allows you to benefit from different tax advantages and withdrawal strategies, maximizing your retirement readiness. For example, use your 401(k) for general living expenses, your Roth IRA for tax-free growth and withdrawals, and your HSA for medical expenses.

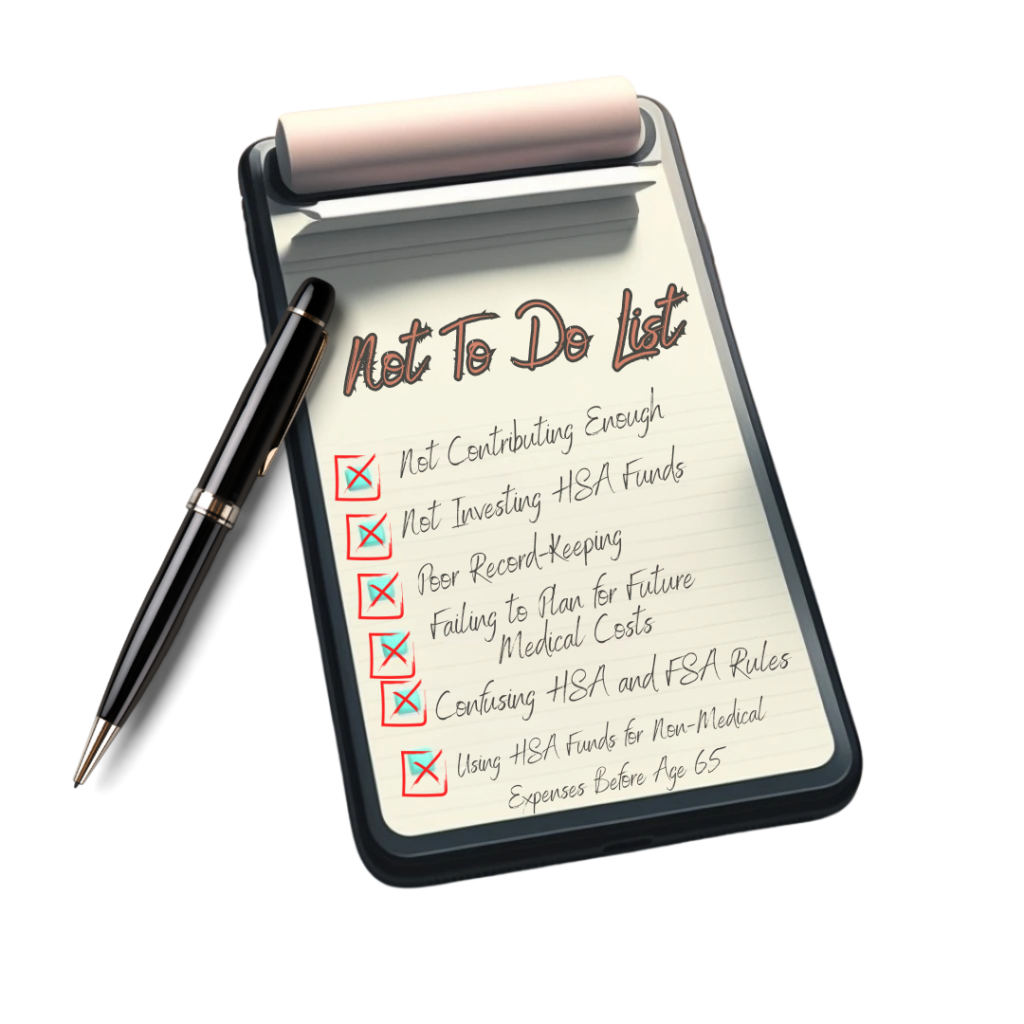

Common Mistakes to Avoid with HSAs

While HSAs are a versatile and powerful savings tool, there are a few common mistakes people make that can reduce their effectiveness:

1. Not Contributing Enough: One common mistake is not contributing enough to your HSA. Even if you can’t contribute the maximum amount each year, contributing as much as you can afford allows you to benefit from the triple tax advantages. Skimping on contributions can mean missing out on significant long-term growth and tax savings.

2. Not Investing HSA Funds: Another mistake is failing to invest HSA funds once you have a sufficient balance. Many people leave their HSA funds in cash, missing out on the opportunity for tax-free growth. Once you have a buffer for immediate medical expenses, consider investing the remainder for potential growth over time.

3. Not Keeping Detailed Records: If you plan to reimburse yourself for medical expenses later, it’s essential to keep detailed records. Without proper documentation, you may not be able to prove that a withdrawal was for a qualified medical expense, which could result in penalties and taxes.

4. Using HSA Funds for Non-Medical Expenses Before Age 65: Withdrawals for non-medical expenses before age 65 are subject to a 20% penalty and ordinary income tax. To avoid this costly mistake, make sure you use your HSA funds exclusively for qualified medical expenses until you reach age 65.

5. Failing to Plan for Future Medical Costs: Not considering future medical costs in your retirement planning can lead to insufficient savings. As healthcare costs rise, having a robust HSA can provide a significant safety net, but only if you plan for it.

6. Confusing HSA and FSA Rules: It’s easy to confuse the rules and benefits of HSAs and FSAs, but it’s important to understand the differences. For example, FSAs have a “use-it-or-lose-it” rule, while HSAs do not. Make sure you understand which type of account you have and the specific rules that apply.

Additional Resources and References

To learn more about maximizing your HSA and retirement planning, here are some external resources from reputable sources:

1. IRS Guide on Health Savings Accounts: For the most accurate and up-to-date information on HSAs, including contribution limits and qualified medical expenses.

• IRS Health Savings Accounts (HSAs)

2. Health Savings Accounts Overview by Healthcare.gov: Provides a clear overview of HSAs, including eligibility requirements and benefits.

• Healthcare.gov – Health Savings Accounts

3. Investopedia – Understanding HSAs and FSAs: A detailed comparison of HSAs and FSAs, including their benefits and limitations.

4. Fidelity Investments – Using an HSA for Retirement: A guide on how to strategically use your HSA as part of your retirement savings plan, including tips on maximizing your account’s growth potential.

• Fidelity – Using an HSA for Retirement

5. Morningstar – Investing Your HSA: An analysis of the benefits of investing HSA funds and strategies for making the most of this opportunity.

• Morningstar – Investing Your HSA

Conclusion

Health Savings Accounts (HSAs) offer a unique blend of flexibility, tax advantages, and long-term growth potential, making them an essential tool for both current medical expenses and retirement savings. Whether you’re looking to save on taxes, cover future healthcare costs, or build a supplemental retirement fund, HSAs provide valuable benefits that can enhance your overall financial strategy.

By understanding the differences between HSAs and FSAs, maximizing your contributions, avoiding common mistakes, and strategically planning your withdrawals, you can make the most out of your HSA. Don’t forget to explore additional resources like our upcoming blog posts and external links to deepen your understanding and optimize your financial planning.

Taking control of your financial future with smart tools like HSAs is a step toward greater security and peace of mind. Start today, and enjoy the benefits both now and in your retirement years.