Introduction

Let’s face it: emergencies are like that one relative who always shows up uninvited—unexpected, unpredictable, and often at the worst possible time. Whether it’s a surprise medical bill, a sudden car repair, or your favorite appliance deciding to retire early, these little (or not-so-little) crises can quickly derail your financial stability. That’s where an emergency fund comes in handy. Think of it as your financial safety net, your first line of defense against the unpredictable nature of life.

But here’s the thing: building an emergency fund doesn’t require you to be rolling in dough. In fact, even on a tight budget, you can start setting money aside and create a buffer between you and the next surprise expense. And guess what? We’re going to walk through it step-by-step, using practical strategies that won’t make you feel like you’re giving up everything you love (yes, your daily coffee can stay). Let’s get started!

Step 1: Set a Realistic Goal

Before diving into the savings game, it’s essential to set a realistic goal. We’re not aiming to win the lottery here; we’re talking about building a manageable emergency fund that grows over time. Start with a small, achievable goal—say, $500. Why $500? Because it’s a good starting point. It’s substantial enough to cover minor emergencies (like that flat tire or surprise dental work) but not so overwhelming that it feels impossible.

Once you hit that $500 mark, give yourself a well-deserved pat on the back! Then, consider aiming higher. The ultimate goal might be to save three to six months’ worth of living expenses, but remember, it’s okay to start small and build up. Rome wasn’t built in a day, and neither is a solid emergency fund.

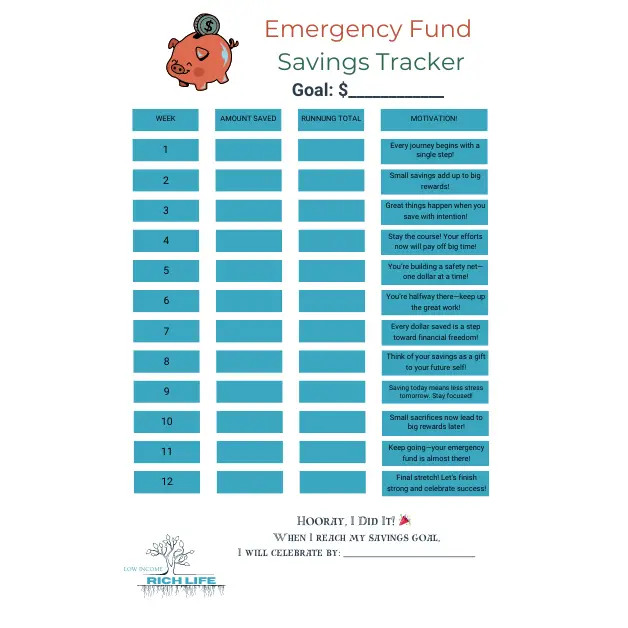

Introducing the Emergency Fund Challenge Tracker!

To help you stay on track, we’ve created a handy Emergency Fund Challenge Tracker. This fillable PDF is designed to help you monitor your savings progress week by week. Whether you prefer to print it out and stick it on your fridge or fill it out digitally on your device, this tracker will keep you motivated and organized. You can download it directly here.

How to Use the Tracker:

- Set Your Goal: Start by writing down your initial savings goal (e.g., $500).

2. Weekly Updates: Each week, jot down how much you’ve saved. The tracker will help you see how close you are to your goal and keep you motivated to continue.

3. Celebrate Milestones: As you fill in each week, take a moment to celebrate your progress. Even small savings add up over time!

Ready to give it a try? Download the tracker and start your savings journey today!

Step 2: Analyze Your Current Spending

Now, let’s talk about analyzing your spending. I know, I know—this doesn’t sound nearly as fun as a night out or a spontaneous shopping spree, but trust me, it’s worth it. Start by tracking every single expense for one month. Yes, every single one. Use an app, a spreadsheet, or even a good old-fashioned notebook. The goal is to see exactly where your money is going.

Are you surprised by how much you’re spending on takeout? Or maybe you’ve got subscriptions you forgot about (hello, random streaming service you haven’t used since last year). This exercise isn’t about making you feel guilty; it’s about awareness. Once you know where your money is going, you can make informed decisions about where to cut back.

Tips for Tracking Your Spending:

• Use a Budgeting App: There are plenty of apps out there that make tracking expenses easy and even fun.

• Review Your Bank Statements: Go through your statements line by line to catch any sneaky expenses you might have missed.

• Categorize Your Spending: Break down your expenses into categories like groceries, dining out, entertainment, and bills. This will help you identify areas where you can cut back.

Step 3: Cut Non-Essential Expenses

Once you have a clear picture of your spending habits, it’s time to make some cuts. I’m not saying you need to give up everything that brings you joy—just the things that don’t bring enough joy to justify their cost. Maybe that’s eating out less frequently or canceling a gym membership you haven’t used in months (no judgment here—we’ve all been there).

Look for those “low-hanging fruit” expenses that are easy to cut. For example, making coffee at home instead of buying it daily, or planning meals to avoid last-minute takeout. Small changes like these can free up money that can go directly into your emergency fund.

Ideas for Cutting Expenses:

• Cancel Unused Subscriptions: Check for any subscriptions or memberships you’re not using and cancel them.

• Cook at Home: Plan meals and cook at home more often. This not only saves money but can be healthier, too!

• Reduce Utility Bills: Simple changes like turning off lights when you leave a room or lowering the thermostat can make a difference over time.

Step 4: Find Small Ways to Save

Now that you’ve trimmed some fat from your budget, let’s talk about finding small, sneaky ways to save. Think of it like finding loose change in your couch cushions, but on a larger scale. Start by setting aside small amounts consistently. Even $5 or $10 saved weekly can add up over time. And remember, the key is consistency.

Ways to Save Without Feeling the Pinch:

• Use Cashback and Rewards Apps: Take advantage of apps that offer cashback on purchases you’re already making.

• Automate Your Savings: Set up automatic transfers from your checking to a savings account right after payday. Start small and gradually increase the amount as you adjust.

• Buy in Bulk: Stock up on non-perishables and household goods when they’re on sale to save money over time.

Step 5: Explore Extra Income Opportunities

If you’ve cut back as much as you can but still want to boost your savings, it might be time to explore some extra income opportunities. Don’t worry—you don’t have to pick up a second full-time job. There are plenty of flexible, low-commitment options out there.

Ideas for Earning Extra Income:

• Freelance or Side Gigs: Use your skills to pick up freelance work or side gigs. Websites like Upwork or Fiverr can be a great place to start.

• Sell Unused Items: Declutter your home and sell unused items online through platforms like eBay, Poshmark, or Facebook Marketplace.

• Part-Time Work: Consider a part-time job that aligns with your schedule and interests. Even a few hours a week can make a big difference.

Step 6: Automate Your Savings

One of the easiest ways to ensure you’re consistently saving is to automate it. Set up an automatic transfer from your checking account to a dedicated savings account each month. This way, you’re not relying on willpower or remembering to move the money—it happens automatically, like magic.

Start with a small amount that won’t break your budget, like $10 or $20 per week, and increase it as you get more comfortable. Before you know it, you’ll have a growing emergency fund without even thinking about it.

Step 7: Keep Your Emergency Fund Accessible but Separate

Finally, let’s talk about where to keep your emergency fund. The key is to keep it accessible, but not too accessible. You want to avoid the temptation to dip into it for non-emergencies. Consider a high-yield savings account that’s separate from your checking account. This keeps the money out of sight, out of mind, but still within reach when you truly need it.

Why a High-Yield Savings Account?

• Better Interest Rates: Your money grows a little bit more while sitting in the account.

• Easy Access: You can access your funds when needed, without penalties.

• Separate from Everyday Funds: Helps avoid the temptation to spend it on non-emergencies.

Conclusion

Building an emergency fund on a tight budget might sound challenging, but it’s all about taking small, manageable steps. Set a realistic goal, use tools like our Emergency Fund Challenge Tracker to stay motivated, and remember—every little bit saved is a step closer to financial peace of mind. Start today, and future you will thank you!

Call to Action:

Ready to start building your emergency fund? Download the Emergency Fund Challenge Tracker here and join us on this savings journey! Don’t forget to share your progress and tips in the comments below! If you want to be a part of a great community while working on your Emergency Fund Challenge, join our Low Income Rich Life Facebook Group.